Marty Levine

April 21, 2023

Filing my 2022 income taxes got me thinking again about how broken our tax system is and the cumulative harm that it does.

As I write this, we are again seeing our national government locked in another round of the battle over government spending and taxation. The Republican House Majority has just announced its package of spending rollbacks that it is insisting on as their price for allowing the federal government to pay its bills. State governments across the country are reaching the time of the year when they must finalize their new budgets. Chicago, my hometown, will be bringing in a new mayor and his first challenge will be building his policy promises into a new budget. Clearly, budgets, and how to pay for the things our governments do, are front and center and clearly, they are divisive.

But as these debates go on we seem unwilling to recognize that under both Democratic and Republican leadership, we have facilitated a massive redistribution of the nation’s wealth. And it has not been from the rich to the poor. Rather, we are watching, amidst all of the heated agreement, a tacit agreement that it is okay to see the rich get richer and the rest of us get a decreasing share of the American wealth pie.

And that is what I’d like you to turn your attention to.

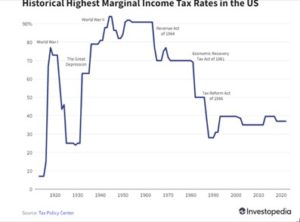

Since the late 1960s, as illustrated by this chart, the pendulum has been swinging toward lowering the tax rates, believing that money in the hands of private spenders will do more good than money spent by the government.

Ronald Reagan expressed this policy quite eloquently:

“Government is not a solution to our problem, government is the problem. … Government does not solve problems; it subsidizes them. Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. If it stops moving, subsidize it. … The problem is not that people are taxed too little, the problem is that government spends too much.”

In the decades since Reagan, under both Republican and Democratic administrations, debates over the role of government, the expansiveness of government programs, and the robustness of our social safety net have been limited by an underlying agreement that supported Reaganomics.

Even when increased spending was approved, we would not significantly raise tax rates; borrowing was the preferred method of financing government whether the need for more spending was the costs of America’s many wars or the need to rescue people from economic disasters.

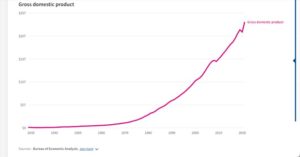

The result, the growing national debt that conservative ideologues consistently seize on as the sword of Damocles hanging over our heads. is well illustrated by this chart produced by the St. Louis Reserve Bank:

We hear a lot of debate about the wisdom of this strategy. Economists like Nobel Prize winner Paul Krugman see debt as a responsible tool to be used when needed. Here’s how he put it in his New York Times column:

“ It’s clear that the U.S. government should be investing heavily in the nation’s future, and that it’s OK, indeed desirable, to borrow the money we need to make those investments. That is, to act responsibly, we must stop worrying and learn to love debt.”

Others see government debt as an existential crisis. J.D. Foster, writing for the Heritage Foundation, made that point in a paper entitled “The Many Real Dangers of Soaring National Debt”:

“…massive deficits, soaring debt, and tepid support for reforms to render America’s entitlement programs affordable pose a grave economic threat. The threat is not theoretical; it is not suppositional. The threat is real and must be faced squarely, and soon. The simple fact is that under current policy, “America is on the verge of becoming a country in decline—economically stagnant and permanently debt-bound.”

But while we argue about the meaning of our debt, while we debate the role of government, we refuse to see what is occurring around us. We are distracted and we are directed to look away from one consequence of these decades of preferring low taxation and borrowing and ignoring that we have allowed the fruits of a growing economy to be taken by a small number of people.

The US economy, still the largest national economy in the world, has grown consistently over decades.

But the fruits of that growth have been very unfairly shared. Only a small slice of the population saw their lives improved as the wealth of the nation grew.

At the top of the pile are a small number, less than .5% of the total population, who have become very wealthy. According to data gathered by the Institute for Policy Studies “as of November 2022, there are 1,468,400 individuals in the U.S. with a net worth of at least $5 million. Their total combined wealth is equal to an astounding sum of $28 trillion. Within this group, there are 64,500 individuals with wealth over $50 million and a combined wealth of $12.5 trillion. And then there are the 728 billionaires who have more than $4.5 trillion in combined wealth, a 34.6 percent increase since the pandemic began in mid-March 2020.

“Since 2012, the richest 1 percent in the U.S. saw their wealth gain close to nineteen times more than the bottom half of the country’s population. For every $100 of wealth created over the last decade, we estimate that $37.40 went to the top 1 percent. The bottom half of U.S. households only saw a $2 gain.”

According to US Census Bureau data, The top 20% of American earners have a median wealth of almost $700,000 as compared to the lowest 20% of earners whose median income is less than $7,000. Median means that in each group half of the population fell below that number.

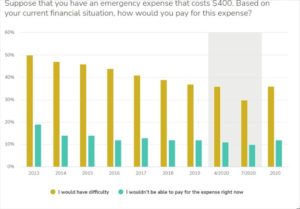

So it is not surprising that for too many citizens even a $400 surprise expense poses a major problem.

If this picture disturbs you as it disturbs me, then consider joining me in calling for a revamping of the tax codes to ensure that everyone pays for their share of government and it becomes harder for a few of us to hoard wealth at the expense of all of us. Senator Ron Wyden described what needs to be fixed as he proposed a set of changes in national law:

“There are two tax codes in America. The first is mandatory for workers who pay taxes out of every paycheck. The second is voluntary for billionaires who defer paying taxes for years, if not indefinitely. Two tax codes allow billionaires to use largely untaxed income from wealth to build more wealth while working families struggle to balance the mortgage against groceries, and utilities against saving for the future. That’s why it’s time for a Billionaire’s Income Tax. The Billionaires Income Tax would ensure billionaires pay tax every year, just like working Americans…“

A recent report from OXFAM America described the benefits of a wealth tax, “a federal wealth tax offers a vital and necessary tool for directly redressing extreme wealth inequality, as well as advancing racial justice, tackling the climate crisis, and protecting democracy. It also offers a reminder that today’s debt-ceiling gridlock is a consequence of giving tax breaks to the ultrawealthy.”

We can see what is ahead of us if we do not address wealth inequality head-on, if we do not ensure that everyone pays their share, their fair share, of a humane government. We can see that we will continue to see millions of our neighbors struggling to afford the basics of life, while a few of us live easily and pad our bank accounts. That’s the reality that our unwillingness to directly address this has given us this bleak present should be enough to spur us on to try another direction.

The barrier is our unwillingness to risk a personal sacrifice.

We seem to remember the beginning of the ancient teaching of Hillel the Elder, “If I am not for myself, who will be for me” but we forget what followed “ But if I am only for myself, what am I” And we need to remember the last line, “If not now, when?”

When is now!