Marty Levine

December 14, 2025

The story remains the same with each new piece of data. The ultra-wealthy use their wealth to gain more influence in the halls of our government so that they can further bend laws and rules to allow them to keep and grow their fortunes. And with that economic muscle, they are able to fend off efforts to spread national wealth more equitably.

Weeks ago, the Washington Post published its look at “How billionaires took over American politics: The concentration of wealth among the richest Americans is unlike anything in history — and so is billionaires’ influence in politics.” They put another spotlight on the decades-long effort to allow money to be translated into power.

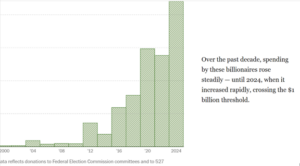

In 2000, the country’s wealthiest 100 people donated about a quarter of 1 percent of the total cost of federal elections, according to a Post analysis of data from OpenSecrets. By 2024, they covered about 7.5 percent, even as the cost of such elections soared. In other words, roughly 1 in every 13 dollars spent in last year’s national elections was donated by a handful of the country’s richest people.

Overall, billionaires have rallied behind Trump’s Republican Party. More than 80 percent of the federal campaign spending by the 100 wealthiest Americans in 2024 went to Republicans, The Post found. Trump himself raised 15 times as much from the 100 richest Americans in 2024 as he did during his first presidential campaign, in 2016. By comparison, Democrat Kamala Harris raised three times as much from the wealthiest in 2024 as Hillary Clinton did in 2016.

Billionaires didn’t acquire their influence in D.C. overnight. President Bill Clinton aggressively courted Wall Street, then signed a sweeping financial deregulation bill and a trade deal strongly backed by wealthy Americans. President George W. Bush also relied heavily on affluent donors, then pushed through tax cuts that benefited the rich, as well as the Troubled Asset Relief Program to bail out big banks. In 2008, Barack Obama became the first presidential candidate in the post-Watergate era to reject public campaign financing, opting out of the system’s spending limitations and instead raising huge sums from private donors.

Bush’s TARP and Obama’s Great Recession stimulus package ignited a populist backlash that persists to this day, paving the way for Trump’s message that, despite his wealth, he shares ordinary Americans’ fury at a rigged system. Yet under Trump, the first billionaire president, the ultra-wealthy have set up shop inside the corridors of government more openly than ever before.

Using that power, they were able months ago to pass H.R.1, commonly called (or derided) as the Big Beautiful Bill. Beyond just extending the tax cuts that gave most of their benefit to the wealthiest and exacerbated the already tilted distribution of wealth, this bill continued the MAGA movement’s efforts to gut our national social safety net, which is the economic backstop for many millions of Americans.

The MAGA government also sought to blunt criticism of their strategy and the growing recognition that fewer and fewer of our people are controlling a larger and larger share of the economic pie. Rather than build on successful programs like the refundable Child Tax Credit that helped dramatically reduce childhood poverty during the COVID crisis they created a new program that provides little direct help and may well steer funds to investment companies who will manage it.

Here’s how the White House describes what they have put in place:

- Trump Accounts will be available to every U.S. citizen born between January 1, 2025, and December 31, 2028. These innovative, tax-advantaged savings accounts — created through President Trump’s Working Families Tax Cuts Act — enable a generation of American children to begin building wealth from the moment they are born.

- Each Trump Account will launch with a one-time $1,000 government seed contribution. Families and others can contribute up to $5,000 annually; the funds will be invested in a broad stock-market index, remain private property under guardian control until age 18, and, if fully funded and left untouched, could grow to as much as $1.9 million by age 28.

The new program takes a concept first introduced by Democratic Senator Cory Booker in 2018. But it has been modified to make it better for the very rich and of little benefit to those with the least, the very people it was supposed to help. The New York Times recently spoke to the economists who were behind the plan as Senator Booker conceived it.

Darrick Hamilton, a professor at the New School for Social Research, whose work with William Darity Jr., an economist at Duke University and Howard University, helped lead to the baby bonds concept.

Dr. Hamilton, who preferred to see a federally funded program, said Trump accounts as constituted would not close the wealth gap between rich and poor and could even make it worse. But he has hope that some future, more left-leaning Congress will take the structure that has been created and improve on it.

Trump’s approach takes out an ongoing government responsibility to add to these accounts over time and makes it a personal responsibility. For so many, there is no discretionary income or existing savings available to add to the fund. The very wealthy can use this plan to earn a large tax reduction, protecting their already excessive fortunes. Rather than help rebalance a skewed economic system, the program just provides a political smokescreen and a way to further aggrandize our fearless leader (“Trump Accounts!”) It provides those seeking government favor and the economic benefits that our government can provide to corporate interests by allowing wealthy individuals to make tax-deductible contributions to expand in a very modest way helping President Trump gain even more headline for a program that will do little to solve a real problem.

Billionaires Michael and Susan Dell were quick jump on board and seize the benefits for themselves. According to the New York Times

Dell and his wife, Susan Dell, are worth an estimated $150 billion…On Tuesday, they announced that they planned to give $250 to roughly 25 million children through the so-called Trump accounts created in this year’s tax bill, Nicholas Kulish reports. The total amount will be $6.25 billion, one of the largest gifts ever to go directly to Americans.

The Dells’ pledge applies to older children, born in 2016 through 2024, who live in ZIP codes where median household incomes are below $150,000 per year. They are working with the Treasury Department to deposit the money into the new individual investment accounts, which they hope the recipients will use to help pay for college or trade school, to start a business, or to put a down payment on a house.

The Dells get a tax benefit for being so charitable; they get very positive PR as very generous people helping those less fortunate, and they get to be on the right side of Donald Trump, which can be very beneficial.

All this will occur without threatening to upset a system that has allowed them both to horde huge amounts of wealth.

But is there value in currying Trump’s favor, you may be asking?

If it weren’t valuable, why would the Dells spend billions of dollars? Why would “donors” provide $300 million to fund the President’s plan to build an auditorium for the White House? Why do so many men of wealth and stature grovel before this President if the benefits were not great, if it was not one way of protecting the status quo that has been so good for them?

I want to end with one more piece of news about the way our current system allows the ultra-rich to bend it to their will. I have written previously about the world’s richest man, Elon Musk’s, self-serving philanthropy. We now know, as reported by the New York Times, that nothing changed in 2024. Mr. Musk continues to have us reward him with tax deductions for helping himself.

Elon Musk’s charitable foundation grew larger than ever in 2024. But, for the fourth year in a row, the huge charity failed to give away the minimum amount required by law — and the donations it did make went largely to charities closely tied to Mr. Musk himself.

Those details were disclosed in the Musk Foundation’s tax filing for 2024, which the group released to The New York Times upon request.

The foundation is now one of the largest in the country, with more than $14 billion in assets. But unlike some other billionaires who have dedicated their nonprofits to broader social or political causes, Mr. Musk in recent years used his nonprofit in ways that narrowly track the interests of his for-profit businesses.

In 2024, the tax filings show, that trend continued. The Musk Foundation gave away $474 million in 2024, more than it has in any prior year. But more than three-quarters of that, $370 million, went to a nonprofit in Texas led by Mr. Musk’s top aide. That nonprofit appears to provide a benefit to Mr. Musk’s business empire: It operates an elementary school in a rural area where many of his employees live, near a cluster of Mr. Musk’s companies…

…In addition, the Musk Foundation gave $35 million last year to an intermediary, called a donor-advised fund, managed by the financial giant Fidelity. But while that money in these vehicles is intended to eventually go to other nonprofits, philanthropists maintain some advisory oversight of the assets. Mr. Musk’s foundation said in the tax documents that its leaders retained influence over the Fidelity assets.

Unless we can bring to power a government ready to take away money’s political power, the rich will continue to serve their own self-interest, and the rest of us be damned.