The Philanthropy of the Mega-Rich is not Very Philanthropic

Marty Levine

March 18, 2024

A quick Google search on the question “What are the benefits of giving?” got me quite a list of possible reasons to give away your wealth:

- Feel happier

- Improve your community

- Society

- Promote generosity in your children

- Help a charitable organization

- Giving is in our nature

- Help others in need

- Improve life satisfaction

- Tax advantages

- Teach gratitude

- Boost morale

- Create positive change in society

- Give life a new meaning

- Giving is good for our health

- Giving strengthens personal values

- Good for mental health

- Reduces stress levels

- You help make a difference

Last weekend, reading David A. Fahrenthold and Ryan Mac’s New York Times article about the world’s second-richest man, Elon Musk, I was reminded that for a small number of very wealthy men and women most of these motivators are irrelevant. For them, philanthropy is too often another tool in their effort to protect and retain their wealth and power. Unfortunately, it is a tool that all of us are paying for because of our tax codes and the rules for political donations allow them to do so.

I’ve previously questioned the philanthropy of the mega-rich and used Bill Gates, Mark Zuckerberg and Jeff Bezos as case examples. The Times’ article focused on Elon Musk and illustrated many of the same self-serving motivations.

For Elon Musk, a way of avoiding taxes by establishing his foundation was a smart step. “At the end of 2021, Mr. Musk had a problem. He had exercised options from a stock bonus plan from Tesla that gave him about $25 billion worth of shares in the automaker. But that came with a price. ‘I will pay over $11 billion in taxes this year,’ he later posted.” . So, when he gave much of this new wealth to his Foundation he reduced his tax bill by as much as $2 billion! That is one aspect of our investment in charity performing good deeds that are supposedly in the public’s interest.

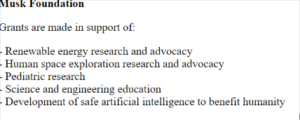

Almost instantly Mr. Musk had one of the largest foundations (the Musk Foundation) in the United States with, according to Fortune, “…$9.4 billion in assets at the end of 2021, according to a tax filing obtained by Bloomberg News .” So, a man who had been a public critic of philanthropy moved billions of dollars to a charitable foundation that he controls to reduce the check he would write to the United States and keep his fortune under his control.

The seriousness of this as a philanthropic venture might be measured by comparing it to other large charitable foundations. John D & Catherine T Macarthur Foundation is about the same size as the Musk Foundation. In its last tax filing, it reported that it had made gifts and grants of more than $300 million. To manage the work of the Foundation it has a 12-member Board is in place overseeing an organization with a large professional and support staff with total salaries of more than $24 million.

George Soros’ Open Society Foundation is slightly smaller than the Musk Foundation. Like the Musk Foundation, it is highly associated with its still-living founder. According to its last filing (2022) it made gave away grants and gifts in of almost $222 million. It is governed by a Board of 7 and its work, too, is supported by a large staff with salaries totaling almost $60 million.

In 2022 The Musk Foundation made gifts and grants of more than $160 million. It is governed by a three-person Board composed of Mr. Musk and two others who are closely related to his sprawling business empire. The Foundation has no paid staff.

Philanthropic foundations, by law, are required to give away at least 5% of their assets every year. Both of our two comparison foundations meet that requirement. The Musk Foundation falls well short of that requirement, as the NY Times article tells us.

In 2021, the Musk Foundation fell $41 million short of the minimum required donation, tax filings show. In 2022, it missed the 5 percent mark by even more: $193 million. That year, Musk’s foundation gave away only about 2.25 percent of its $7 billion in assets, far below the 5 percent minimum, tax filings show.

With shortfall piled on shortfall, the Musk Foundation was then left $234 million behind by the end of 2022, the fourth-largest gap of any foundation in the country, according to Cause IQ, a firm that analyzes charity data.

Information about most Foundations, who their leadership is, what their priorities for giving away their money is and access to their financial data is available to the public, very often via their websites. Not true for the Musk Foundation. Their Web site is but one page.

From what I can see in the actual grants coming out of the Foundation it seems that those making decisions are using a very different and more personally driven rubric, a rubric which tends to more align with Mr. Musk’s personal and business interests.

Mr. Musk, instead, used his small foundation to help groups tied to him personally, including a food charity run by his brother and a “Temple of Whollyness” that was set on fire at the 2013 Burning Man festival, an annual event that he often attends.

He also founded his own nonprofit school called Ad Astra — Latin for “to the stars” — to explore new ways to teach math and science.

But that school, too, would serve a personal purpose for Mr. Musk. In its first year of operation out of his home in the Bel-Air neighborhood of Los Angeles, five of Ad Astra’s 14 students were his own children…

Ad Astra later moved to SpaceX’s Hawthorne, Calif., headquarters and grew to more than 50 students. About half were related to SpaceX employees…

Mr. Musk has been able to use grants from the Foundation to burnish his business interests. For example, shortly after a rocket blew up at his rocket company (SpaceX)’s launchpad in Texas causing a public relations and an environmental problem, the Musk Foundation made large grants to neighboring Brownsville, Texas, a community impacted by the explosion and which had not moved fast enough, in his opinion, with its regulatory processes as SpaceX expanded.

Whether Mr. Musk or anyone should be allowed to amass the fortune that is his is the subject of another discussion. But, it is of great concern that our charitable laws give him massive tax breaks with so little accountability. Whether Mr. Musk wishes to give his money away is not my issue. He should do with it as he wishes. But I am concerned that we reward his decisions with massive tax breaks with no accountability or and with no need to justify to the public how that money is actually spent in order to get those rewards.

Public interest should be about us all, our goals, needs, and priorities as a nation. It should not be left to each of us to define it as we see fit.

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but instead of that this is excellent blog A fantastic read Ill certainly be back

Your blog is a testament to your expertise and dedication to your craft. I’m constantly impressed by the depth of your knowledge and the clarity of your explanations. Keep up the amazing work!

I just wanted to drop by and say how much I appreciate your blog. Your writing style is both engaging and informative, making it a pleasure to read. Looking forward to your future posts!

Your blog is a breath of fresh air in the often mundane world of online content. Your unique perspective and engaging writing style never fail to leave a lasting impression. Thank you for sharing your insights with us.

Just wish to say your article is as surprising. The clearness in your post is just cool and i could assume you’re an expert on this subject. Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please keep up the enjoyable work.

I loved as much as youll receive carried out right here The sketch is attractive your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this hike

you are in reality a just right webmaster. The site loading velocity is incredible. It seems that you are doing any unique trick. In addition, The contents are masterwork. you have performed a wonderful task on this topic!