Marty Levine

December 9, 2023

It’s that time of year. My mailboxes are overflowing with requests for year-end donations, each with a story about how my charitable support helps a non-profit organization fulfill its life-changing mission. Salvation Army bell ringers stand in front of stores. My wife and I have just completed our final giving decisions for 2023 and have gotten those checks in the mail. It is, indeed, that time of the year.

Philanthropy is very important for our nation’s well-being. Just in my small sample of requests for support are appeals from museums, food banks, those serving victims of domestic violence and the homeless, universities, counseling organizations, community funds, religious organizations, social justice organizations, and more. They come from organizations near and far.

And my mailbox is just a pinhole through which we can see a small part of a very large non-profit sector that relies on the generosity of individuals to fill gaps so they can do what government can’t or won’t do to build a more humane, equitable nation.

Just how large a helping hand are they leaning on? Altogether, Americans donated $499.33 billion to this diverse array of non-profit organizations, organizations that we lump together as charities, in 2022.

For that, I guess we should be thankful.

But I think we should be taking a more serious look behind that staggering number to see, as I’ve written about repeatedly, what we are actually getting in return for giving many of these donors significant tax benefits. And the cost of the public subsidy for this charitable giving is large as recently reported by the Institute for Policy Studies:

- We know for certain that $73.34 billion in tax revenue was lost to the public in 2022 due to personal and corporate charitable deductions.

- If we include just the little data we have about charitable bequests and the investments of charities themselves, the revenue loss is pushed up to roughly $111 billion.

- And if we also include the capital gains revenue lost from the donation of appreciated assets, the true revenue costs of charity likely add up to several hundreds of billions of dollars each year.

If we lived in a nation where government ensured a reasonable quality of life for all, then I would be much less concerned about how little attention we paying to how this investment in encouraging charity is being spent. But we don’t live in that reality. Food is scarce for millions; millions do not have adequate housing; healthcare is still unequally available; funding for education is less than it needs to be; and that just begins my list of dreams about an equitable world.

If those benefits were equitably spread across the population I would also be less of a curmudgeon about this. But they are not. Those who make larger gifts can and do benefit most.

And as wealth is becoming more and more concentrated in a smaller and smaller slice of our population, so too are the tax benefits becoming more and more concentrated.

Perhaps once upon a time, it was true that charitable giving reflected broad participation in the work of the nonprofit sector. But over the years, more and more of the annual pool of giving has been coming from a smaller and smaller number of large givers. This trend was reflected in the results of the just completed “Giving Tuesday” effort, as reported by the Chronicle of Philanthropy:

“Donation trends are very volatile right now, and there’s a lot that’s going on that’s very concerning, including a decrease in donor participation,” Asha Curran, CEO of GivingTuesday, told the Chronicle before the total had been tallied.

“Lower participation could be one reason the day failed to bring in significantly more donations than it did in 2022. Just 34 million people made contributions on GivingTuesday, down 10 percent from last year.

“We are concerned to see a decline in participation in line with giving trends from the past year,” Curran said in the news release announcing the figures. “GivingTuesday’s mission is to inspire generosity among as many people as possible, not just raise as many dollars as possible.”

The purpose of granting tax benefits for the acting of charitable giving was to encourage generosity. It was to reward people sharing their resources with those in need of assistance and the organizations that provide that assistance. It was not to be a way to avoid taxation for the wealthy or to be just one more tool in the hands of wealth managers. But that is what has happened.

For too many large givers, charitable giving meets the letter of the law but it does not mean that those funds are actually being used to build that better world and help those in need. It is being given to an organization that qualifies the donor for a tax deduction but does use those funds for a public benefit. Even the concept of a gift has been altered. In many cases large donors “give” their funds away to an organization that remain in total control of those funds, so in fact they have not actually given those funds away at all.

How does that work? For the wealthy, it is easy to set up their own charitable organization in the form of a non-profit foundation. On paper, this is a separate organization that has its own independent mission of doing some public good. But there is nothing in the current law that prevents the donor from remaining in control of that foundation nor from actually being paid from the funds that they have donated. While current law requires foundations to distribute to at least 5% of their assets, it is possible to meet this requirement without actually giving away those funds or seeing an actual public benefit be delivered. The cost of running the foundation, including even salaries paid to the people who created the foundation are part of that 5%!

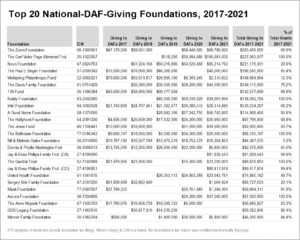

As an alternative, a donation can be made to a charity to establish a donor-advised fund (DAF). While the recipient organization has been given those funds and the donor has gotten their tax deduction, there is nothing to prevent the recipient organization from agreeing that the original donor will be given the power to decide if and how the DAF distributes its funds. And there is no current requirement that it distribute anything at all. The wealthy donor gets the tax benefit but still retains control.

Shockingly a series of new charitable organizations have blossomed to manage this DAF racket. They are incorporated as tax-exempt, charitable organizations but have only one purpose — to grow benefit from the business of investing and managing the “charitable” contributions they receive for the DAFs they manage.

Foundations can meet their annual distribution requirement by giving funds to a DAF. And DAFs can give funds to Foundations or other DAFs. All without benefiting the public and all without requiring any public voice in how these funds are spent.

In 2015 the editors of Nonprofit Quarterly published their definition of Philanthropy. “ A Greek term which directly translated means ‘love of mankind.’ Philanthropy is an idea, event, or action that is done to better humanity and usually involves some sacrifice as opposed to being done for a profit motive. Acts of philanthropy include donating money to a charity, volunteering at a local shelter, or raising money to donate to cancer research.”

Looking at this definition it is clear that much of the giving we are rewarding falls so very short of this definition.

I’ve been here before, ending an article on what I strongly feel is a failed philanthropic regime in our nation. A structure that is built on a willingness to believe that wealth equates to wisdom; that tax benefits should have no connection to democratic decision-making and national priorities and that we should rely on individual generosity rather than a robust government to ensure all lives have value and can live safely and with dignity but fails to deliver on any of these assumptions.

Here’s one light in this darkness. The Institute for Policy Studies had launched a new Charity Reform Effort to address this problem. If you share my concern, I suggest you check it out.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

The information in this article is invaluable. I’m so glad I stumbled upon it.

Your depth of understanding on this topic is impressive.

I appreciate you sharing this blog post. Thanks Again. Cool.

Your writing is both informative and entertaining.

of course like your website but you have to check the spelling on several of your posts. A number of them are rife with spelling issues and I in finding it very troublesome to inform the reality on the other hand I will certainly come back again.