Marty Levine

January 14, 2023

The rate of inflation has come down. Unemployment remains at historically low levels. We keep adding hundreds of thousands of new jobs every month. The stock market is rising. Wages are rising.

Why aren’t we celebrating?

Despite all this good news, we are in a national funk. We are angry and dispirited. We are so unsure of our personal and family security that an incumbent President in a time of economic prosperity has historically low approval ratings and is in a neck-and-neck battle with an indicted deeply flawed rival.

From my perspective, there is good reason to feel unhappy with our national state of affairs. When taken as a whole, our nation may be at a peak, but for too many, the benefits of this success have not been shared. The wealth of the nation is so uneven and I would say unfairly, shared that many feel left out and uncertain of what lies ahead. For a small number of us, this is a time of unprecedented wealth but for most “average” folks, these times remain very tough and very uncertain.

We don’t have to look very far for evidence of how this skewed economy leaves people on the outside looking in. Just this week I came across this story in the San Diego Union-Tribune bemoaning how the demand for programs serving households facing food insecurity was on the rise while their philanthropic support was falling. The result was described by Alondra Alvarado, the president and CEO of the San Diego Hunger Coalition: “unfortunately, our recent data reveals a concerning trend in San Diego County, as we find ourselves reverting to pre-pandemic meal gap levels, with a staggering 13.4 million meals unmet in the latest data from June 2023…”

This is not a unique story about San Diego; food banks are struggling to meet demand in cities and towns from coast to coast. This is not unique to food programs. Housing insecurity is rampant. Struggles to afford needed medical services are widespread. Millions of people are just worried that they cannot afford a decent standard of living in this time of great wealth.

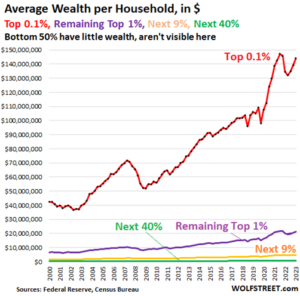

At the same time, the wealth of the nation seems to inexorably flow upward to a very small segment of the people. Just months ago the St. Louis Federal Reserve Bank issued its periodic “The State of U.S. Wealth Inequality” report and told us that “the top 10% of households by wealth had $7.0 million on average. As a group, they held 69% of total household wealth. The bottom 50% of households by wealth had $51,000 on average. As a group, they held only 2.5% of total household wealth.”

This quarterly snapshot gives us one more data point along a path of wealth concentration we have been on for years, leaving us with the reality that our current system results in more and more of wealth being hoarded by a small slice of the population :

And this is not by chance.

We have built this into national and state policies that allow the wealthy to shield their fortunes from taxation and regulation and which provide multiple avenues for avoiding their contributing an equitable share of their wealth with the society which has made their wealth possible.

Just in the last few weeks we have received two studies that underscore how slanted our system is.

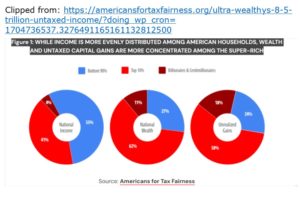

Americans for Tax Fairness just days ago released “The Ultra-Wealthy’s $8.5 Trillion of Untaxed Income” which tells how the wealthy can bury their fortunes as untaxed as “unrealized capital gains” that remain hidden from our tax systems.

According to an analysis by American for Tax Fairness of new Federal Reserve data on household income and wealth, [ just 64,000] America’s billionaires and centi-millionaires…collectively held at least $8.5 trillion of “unrealized capital gains” in 2022. These profits from unsold investments constitute the largest source of income for the super-rich…

Equally important, the vast majority of that typical household’s unrealized gains—$33,000, or 70%—are in the appreciated value of the family’s primary residence. Family homes are subject to an annual wealth tax in the form of state and local property taxes that reflects the residences’ increased value…for the ultrawealthy, the increase in value of the primary family home represents…less than 2%…

If our supposedly progressive tax system is supposed to ask the wealthiest to contribute the most in taxation to pay for the cost of government and the support it provides to all Americans, these laws have been constructed so that they provide a gaping open door to keep wealth from being taxed at all. The wealthy just get to keep it “unrealized” but available to serve as collateral should they need to borrow to pay any and all bills and to support lavish lifestyles. They can also be given away as charitable donations without having to pay any tax on the increased value. And, when the time comes to transfer this wealth to the next generation no tax is collected. These are all benefits not available to any but the wealthiest.

We reward the hoarding of wealth and the creation of dynastic wealthy families.

Another recently published study from the Institute on Taxation and Economic Policy focused on the tilted systems of state and local taxation that build on the inequity of the federal system,

The lower one’s income, the higher one’s overall effective state and local tax rate. On average, the lowest-income 20 percent of taxpayers face a state and local tax rate nearly 60 percent higher than the top 1 percent of households. The nationwide average effective state and local tax rate paid by residents to their home states is 11.3 percent for the lowest-income 20 percent of individuals and families, 10.5 percent for the middle 20 percent, and 7.2 percent for the top 1 In 34 states, low-income families are taxed at higher rates than everyone else despite having the least ability to pay. Six states plus D.C., on the other hand, tax low-income families at lower rates. percent.

Heavy reliance on sales and excise taxes makes tax systems more regressive

Here’s a chart that show how repressive state and local taxes are across the nation:

This bias toward the rich is not by chance it is by design. It is not a flaw; it is a protected feature of our nation. We see wealth as a personal achievement and ignore the reality that it is not possible outside the context of all that our nation provides. It ignores the reality that no accomplishment is possible without the contribution of the wisdom and effort of large groups of people. And it allows us to forget any moral or ethical responsibility to ensure our collective welfare.

The human impact of this inequity is that while some are very, very rich, many are left struggling. And with a government at every level struggling to find enough revenues and charitable organizations increasingly reliant on the whims of the mega rich, the safety net is weak. Many are left out in the economic cold.

Is it surprising that many feel that our nation and its government have let them down and do not care about them? Despite promises that life will get better it never seems to improve enough.

Perpetuating this system provides the opening for those on the right, the MAGA crew, to fertilize the seeds of hate and envy. If my life seems hopeless it becomes easy to focus attention on foreigners, poor people, people of color, or women as the reason I am being forgotten and left behind. It is easy to pit one group against the other as everyone below the favored elite fights for scraps.

But I think it is those who say they are for the poor and middle class, our Democratic leadership, that are the major causes of this unsettled and unhappy nation. When they have been in power they have not acted to balance the system and make it less regressive. And in not doing what they could, they dealt our hope and trust a severe blow.

Just this week the Democratic leaders of the Senate (where they are in power) and the House signed off on a budget agreement that the Center on Budget and Policy Priorities described as have “a topline funding level for 2024 rightly ensures that overall funding available for non-defense programs will stay at $773 billion, the already tight level set in May’s bipartisan debt ceiling agreement. These long delays in funding decisions are harmful — they hamper federal agencies’ ability to deliver public services efficiently and effectively as they wait for final decisions. This level is at best a funding freeze at a time when costs have risen, meaning that public services that people and communities count on will be cut. “

This was the best they could do, in order to give in without a fight.

While they declared this was a victory they left the programs that affect the lives of millions, like the food programs in San Diego, scrambling for alms rather than effectively fund and feed the people.

So when both parties do nothing, not even make a good fight, why are we surprised that people do not care about voting and do not feel good about their futures?

We need leaders who understand this and are willing to stand up and fight for the better, equitable country they say they want. Their actions speak louder than their words. Voter apathy is the result.

There is definately a lot to find out about this subject. I like all the points you made

Just wish to say your article is as surprising. The clearness in your post is just cool and i could assume you’re an expert on this subject. Fine with your permission allow me to grab your RSS feed to keep updated with forthcoming post. Thanks a million and please keep up the enjoyable work.

Fantastic site Lots of helpful information here I am sending it to some friends ans additionally sharing in delicious And of course thanks for your effort

Fantastic read! I was especially impressed by the depth provided on the topic, offering a perspective I hadn’t considered. Your insight adds significant value to the conversation. For future articles, it would be fascinating to explore more to dive deeper into this subject. Could you also clarify more about the topic? It caught my interest, and I’d love to understand more about it. Keep up the excellent work!